Tohru in der Schreiberei, Munich's newest three-Michelin-star restaurant

Section: Arts

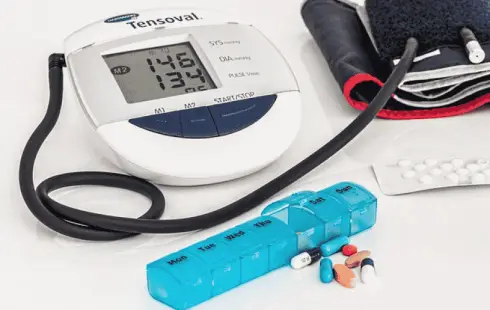

Living abroad as an expatriate comes with its own set of challenges, one of which is ensuring access to high-quality healthcare. Private health insurance for expatriates is an essential consideration, offering comprehensive coverage and peace of mind. In this article, we will explore the top 10 best private health insurers for expatriates (not local PKV providers, as residents would normally take), taking into account factors such as coverage, flexibility, customer service, and global network.

Living abroad as an expatriate comes with its own set of challenges, one of which is ensuring access to high-quality healthcare. Private health insurance for expatriates is an essential consideration, offering comprehensive coverage and peace of mind. In this article, we will explore the top 10 best private health insurers for expatriates (not local PKV providers, as residents would normally take), taking into account factors such as coverage, flexibility, customer service, and global network.

Cigna Global: Cigna Global tops the list due to its extensive global network and robust coverage options. With plans tailored specifically for expatriates, Cigna offers comprehensive coverage for medical emergencies, routine check-ups, and specialist consultations. The company's 24/7 customer service ensures expatriates receive the support they need, regardless of their time zone. Additionally, Cigna's MyCigna app allows policyholders to manage their insurance, locate healthcare providers, and access medical records conveniently.

Aetna International: Aetna International is renowned for its flexibility and comprehensive coverage plans. With a wide range of options available, expatriates can tailor their insurance to meet their specific needs. Aetna's expansive network of healthcare providers ensures global access to quality medical facilities. The insurer's Health Hub platform offers a wealth of health and wellness resources, including virtual doctor consultations and personalized well-being programs.

Allianz Worldwide Care: Allianz Worldwide Care stands out for its exceptional customer service and extensive coverage. The insurer provides a range of plans to suit different budgets and requirements. Their international network of healthcare professionals ensures expatriates have access to quality medical care wherever they may be. Allianz's online portal provides easy access to policy details, claims, and assistance services, simplifying the process for expatriates managing their health insurance abroad.

AXA Global Healthcare: AXA Global Healthcare offers comprehensive health insurance solutions for expatriates, combining coverage, flexibility, and excellent customer service. With a focus on personalized care, AXA offers a range of plans to suit different needs and budgets. The insurer's global network of hospitals and clinics guarantees access to quality healthcare services. AXA's online tools and mobile app allow policyholders to manage their insurance, submit claims, and access important information on the go.

Bupa Global: Bupa Global is a trusted name in the international health insurance market, providing tailored plans for expatriates. The insurer offers comprehensive coverage, including routine healthcare, emergency medical services, and specialist treatments. Bupa's extensive network of medical providers ensures expatriates receive top-notch care worldwide. Their digital tools, such as the Bupa Global Mobile app, make managing insurance and finding healthcare providers convenient and hassle-free.

Now Health International (80 words): Now Health International excels in providing flexible and comprehensive health insurance plans for expatriates. Their plans are designed to cater to individual needs, allowing policyholders to customize their coverage. Now Health's strong global network ensures access to quality healthcare services, while their dedicated customer service team is available 24/7 to assist expatriates. The insurer's secure online portal enables policyholders to manage their insurance, submit claims, and access policy details effortlessly.

GeoBlue: GeoBlue specializes in providing international health insurance coverage for expatriates. With an emphasis on comprehensive coverage and access to an extensive global network, GeoBlue ensures expatriates have peace of mind while living abroad. The insurer offers a variety of plans to suit different needs, including plans for short-term trips and long-term assignments. GeoBlue's online tools and mobile app make it easy to find healthcare providers, manage claims, and access medical information.

Pacific Prime International (80 words): Pacific Prime International is known for its expertise in sourcing and tailoring health insurance plans for expatriates. They work with a range of reputable insurers to offer comprehensive coverage options. Pacific Prime's team of experienced advisors guides expatriates through the insurance selection process, ensuring they find a plan that fits their unique requirements. The company's customer service team provides ongoing support, making it easier for expatriates to manage their health insurance needs.

Expacare: Expacare is a specialist provider of health insurance solutions for expatriates. The insurer offers a range of plans designed to meet the specific needs of expatriates in different parts of the world. Expacare's comprehensive coverage includes medical emergencies, routine check-ups, and access to specialists. Their dedicated customer service team provides support and assistance, ensuring expatriates receive the care they need, no matter where they are based.

International Medical Group (IMG) (80 words): IMG is a leading provider of international health insurance, offering tailored plans for expatriates. The insurer's plans cover a wide range of medical services, including emergency medical treatment, preventive care, and mental health support. IMG's expansive network of healthcare providers ensures access to quality medical facilities globally. Their online portal and mobile app allow policyholders to manage their insurance, locate healthcare providers, and access important policy information conveniently.

Conclusion: When it comes to selecting a private health insurer as an expatriate, comprehensive coverage, global access to quality healthcare, and excellent customer service are paramount. The top 10 insurers mentioned above, such as Cigna Global, Aetna International, and Allianz Worldwide Care, excel in meeting these requirements. By choosing the right private health insurer, expatriates can ensure their well-being is protected, allowing them to focus on making the most of their international experience.

Section: Arts

Section: Health

Section: Fashion

Section: Politics

Section: Fashion

Section: News

Section: Fashion

Section: Arts

Section: Politics

Section: Health Insurance

Both private Health Insurance in Germany and public insurance, is often complicated to navigate, not to mention expensive. As an expat, you are required to navigate this landscape within weeks of arriving, so check our FAQ on PKV. For our guide on resources and access to agents who can give you a competitive quote, try our PKV Cost comparison tool.

Germany is famous for its medical expertise and extensive number of hospitals and clinics. See this comprehensive directory of hospitals and clinics across the country, complete with links to their websites, addresses, contact info, and specializations/services.

Join us at the Kunstraum in der Au for the exhibition titled ,,Ereignis: Erzählung" by Christoph Scheuerecker, focusing on the captivating world of bees. This exhibition invites visitors to explore the intricate relationship between bees and their environment through various artistic expressions,...

No comments yet. Be the first to comment!